Caution spread through the global SVOD sector over the last year. US-based platforms now concentrate more on improving profitability than on adding subscribers. Far fewer platform launches are likely in coming years as companies focus on the countries with the best yields.

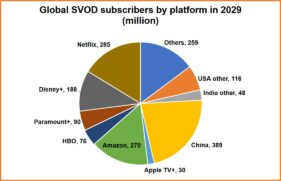

Despite this, there is still plenty of growth left in the sector. Global SVOD subscriptions will increase by 317 million between 2023 and 2029 to reach 1.75 billion*. By 2029, 25 countries will have more than 10 million SVOD subscriptions – collectively providing 90% of the global total.

The US overtook China in 2021 to become the subscription leader. China and the US will together account for nearly half of the global total by 2029.

From the 317 million extra subscriptions between 2023 and 2029, the US will add 18 million. China will increase by 17 million, with Brazil up by 25 million, India by 31 million and Mexico 14 million.

Six US-based platforms will have 939 million SVOD subscribers by 2029 (54% of the world’s total), up from 740 million in 2023 (52%). These platforms will increase their subscriber bases by 199 million.

“No foreign platforms will enter China. China’s domestic players will account for 24% of the global subscription total by 2029. Foreign platforms are not expected to reenter Russia before 2029.” said Simon Murray, Principal Analyst at Digital TV Research.

So there are opportunities in the global SVOD sector, but the global players are being much more selective about where they invest.

* Digital TV Research’s Global SVOD Forecasts report, published in September 2023

Digital TV Research provides subscribers with 30+ reports each year – on a global, regional and country level. Our OTT and pay TV forecasts are updated every six months. Our reports reflect this rapidly-changing environment, with in-depth analysis of emerging sectors such as FAST. Annual subscriptions provide a substantial discount on buying all of the reports individually. Subscribers also receive two mega excel workbooks with all of the forecasts in one place and two presentations/Q&A sessions each year.

Digital TV Research Limited was established by Simon Murray in January 2011. Simon’s extensive international industry knowledge and contacts have been built up since he began covering global media developments in 1988.

Find out more on the MIPCOM website: https://www.mipcom.com/en-gb.html