“It was a real pleasure for me to speak at MIPTV’s first ever FAST & GLOBAL Summit last month. When you are addressing a ‘standing room only’ audience the level of interest in the topic you are talking about is made very clear. Free ad-supported streaming TV (FAST) is a very hot issue at the moment and there are good reasons for that to be the case. FAST is generating all of this attention because FAST channels are starting to prove that they offer a wide range of benefits to content owners, such as an important new option to monetize old and unused library content or to offer a new content bundle.

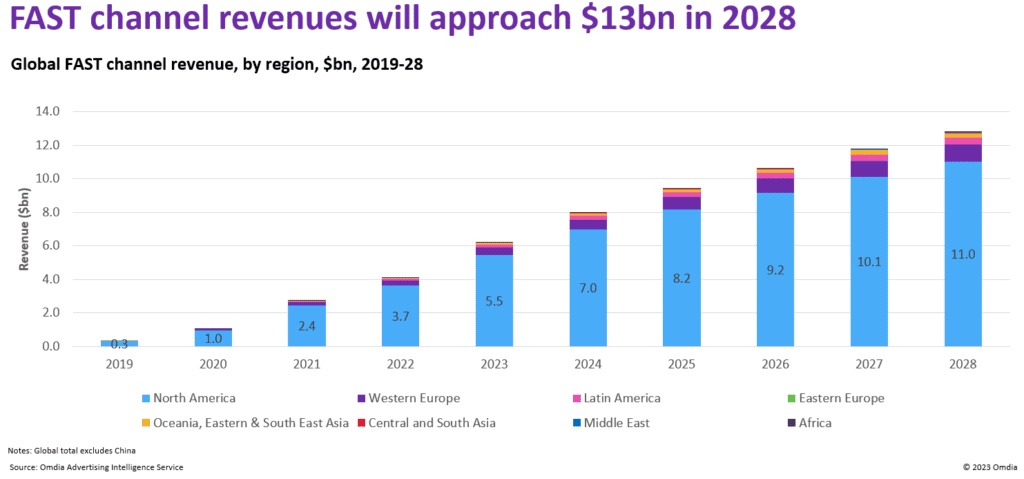

Earlier this year, Omdia released a set of forecasts that quantified the global size of the FAST market. We have now released a new set of research that goes a step beyond that global analysis to carry out an even deeper dive into the subject, looking more closely at a range of individual country-level data.

This new research anticipates that FAST channels will generate global revenue of $6.3bn in 2023. It will come as no surprise to anyone that the US is the sector’s leading force, with FAST channels in the States expected to generate more than 80% of the global figure throughout the entirety of Omdia’s 2023 to 2027 forecast period. However, looking beyond the US, there are positive indicators for numerous other countries. In particular, we are forecasting that the UK, Canada, and Australia are all about to experience major spikes in FAST activity, leading to rapid expansion in those territories over the next four years. They benefit from being able to use English-language content originating from the US, but there are also big opportunities happening for non-English language content. Though the US will continue to dominate the market, a $1.6bn revenue opportunity will emerge for FAST channels outside the US by 2027.

By Maria Rua Aguete, Senior Research Director, Media and Entertainment, Omdia

Download Omdia’s report now to access more data and insights 👉