Papercup recently launched a report with media analyst Gavin Bridge on Spanish streaming (and remembering Brazil, Portuguese-language streaming), focusing on, but not limited to, the free ad-supported streaming TV space. Since Gavin is the anointed FASTmaster, the report compares major FAST providers’ channel coverage by genre in Latin America, Spanish, and Portuguese-language channel counts for the major platforms in the US and two of LatAm’s most significant countries – Mexico and Brazil. Plus, the most up-to-date US English-language channel count. From a broader streaming perspective, the report positions FAST within the wider streaming ecosystem, zooming in on some of the initiatives by media companies to sustain their subscriptions as ad-supported offerings grow in popularity.

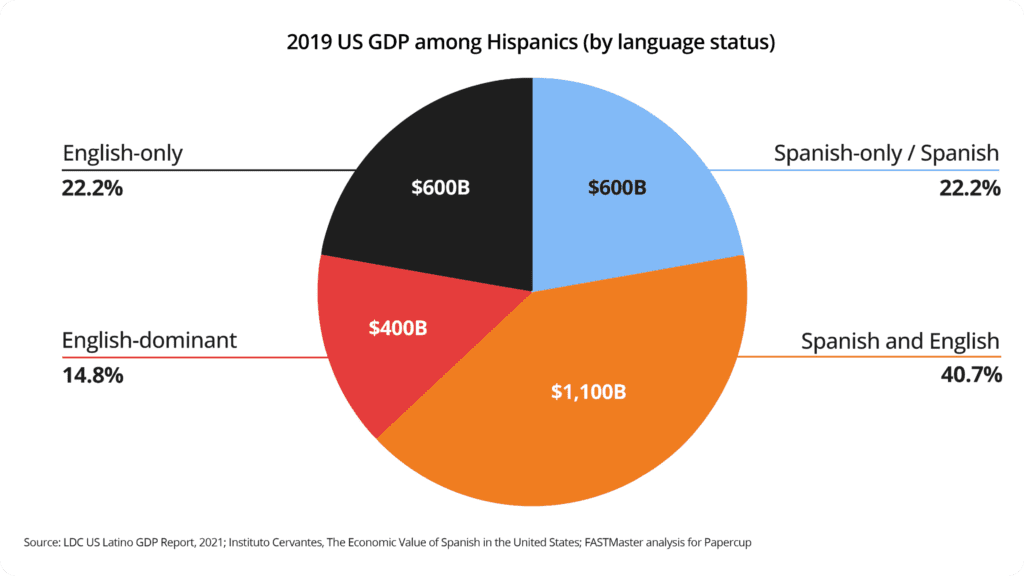

They also called up some of their pals in the industry to get the download on their experience of distributing across Latin America and reaching US Hispanic audiences in America, a segment worth $3.2 trillion dollars in 2021. Exclusive comments come from Banijay’s VP of Digital, Shaun Keeble; LoveTV Channels founder Teresa Lopez; EVP of Revenue, Distribution and Data Operations at Vevo, Natalie Gabathuler-Scully; Chief Business Officer at Fuse Media, Patrick Courtney; and Jill Goldfarb, SVP at Trusted Media Brands.

The current FAST state of play

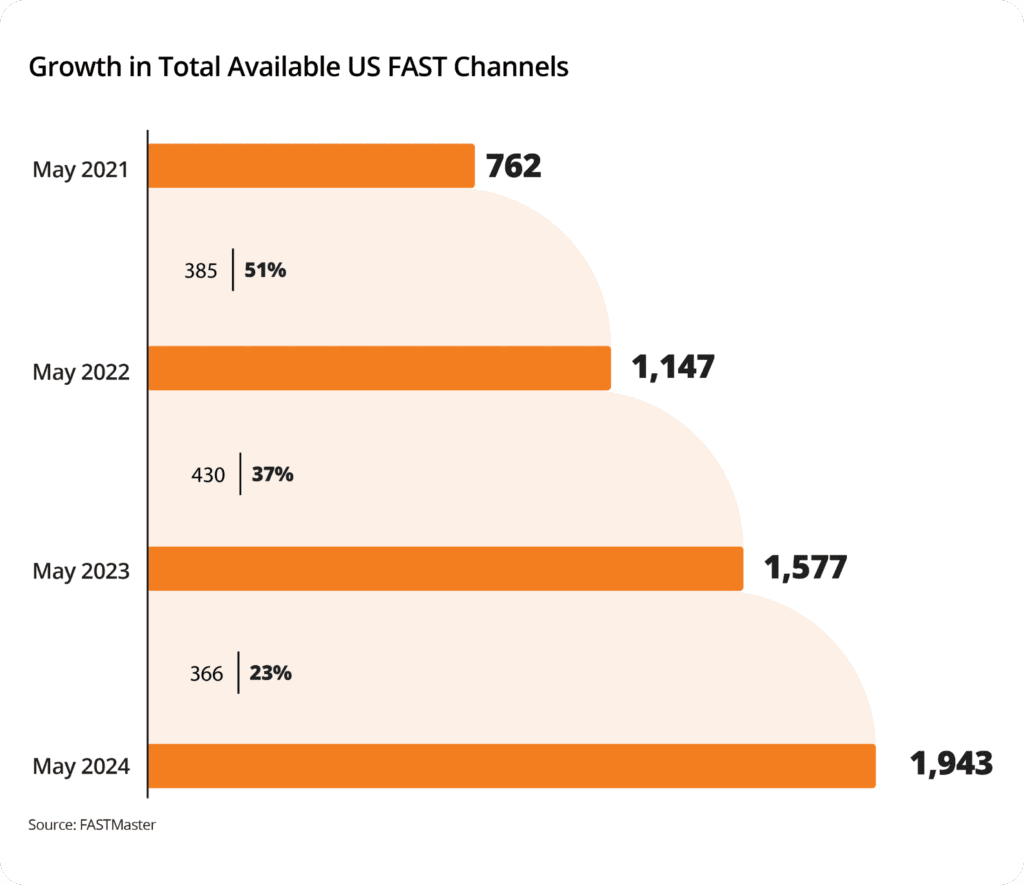

We know FAST is a quick-growing business, but the growth opportunity varies by region. The US can now be considered the world’s first mature FAST market, with total available channel growth slowing and an ever-growing share of these channels coming from big entertainment companies (like Warner Bros. Discovery, Paramount and NBCUniversal), studios (Sony Pictures, Lionsgate) and FAST platforms’ owned-and-operated channels (Samsung TV Plus, Freeview, Roku Channel).

A snapshot of the wider TV industry

Pay TV globally has taken a hit as the TV and streaming market has fractured over the past few years. Latin America lost 20 million pay TV customers between 2017 and 2023, and North America will see pay TV customers drop below 50% in 2024 In Latin America.

Nor have streamers been immune to subscriber churn as a result of a fractured market, with many (successfully) introducing ad-supported offerings to combat declining subscriber numbers. Between January 2024 and May of the same year, Netflix almost doubled ad-tier subscribers.

Bundling has also become an essential way for streamers to combat churn. The recent announcement of the Xfinity StreamSaver bundle from Comcast, incorporating Netflix, Peacock and Apple TV+ for a 30% saving, is the latest in the growing trend of streaming bundles (others include Disney+/ESPN+/Hulu, and upcoming Disney+/ Hulu/Max and Venu Sports) created to appeal to consumers and boost total subscription figures for individual services. For content owners, this means more opportunities to reach larger audiences, and it will be a trend we can expect to see on a regional and global basis.

Why content owners are prioritizing Latin America ?

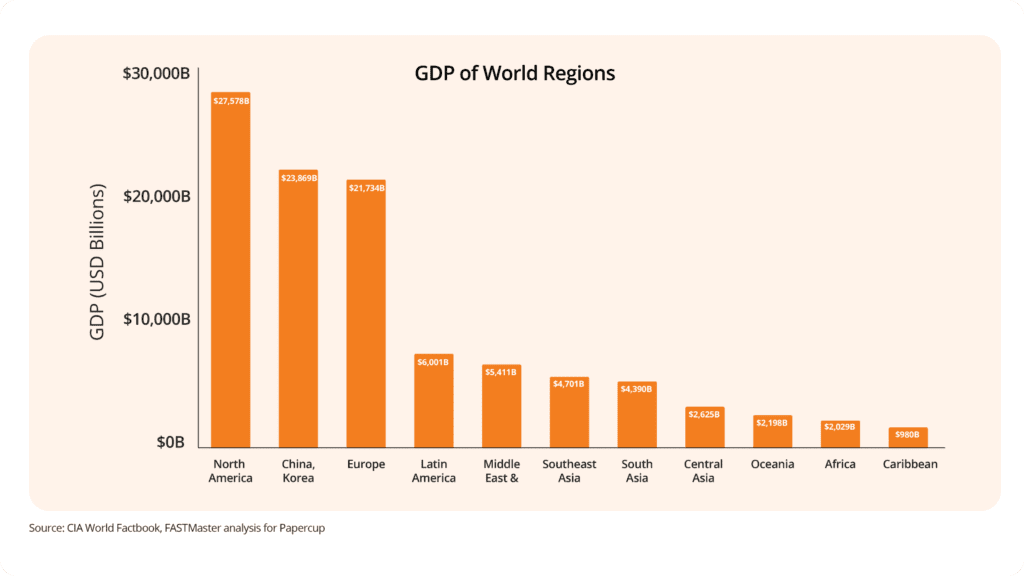

Latin America is home to two of the world’s 18 economies worth over a trillion dollars annually. With only two major languages spoken across the region, Latin America offers unmatched efficiencies to content owners.

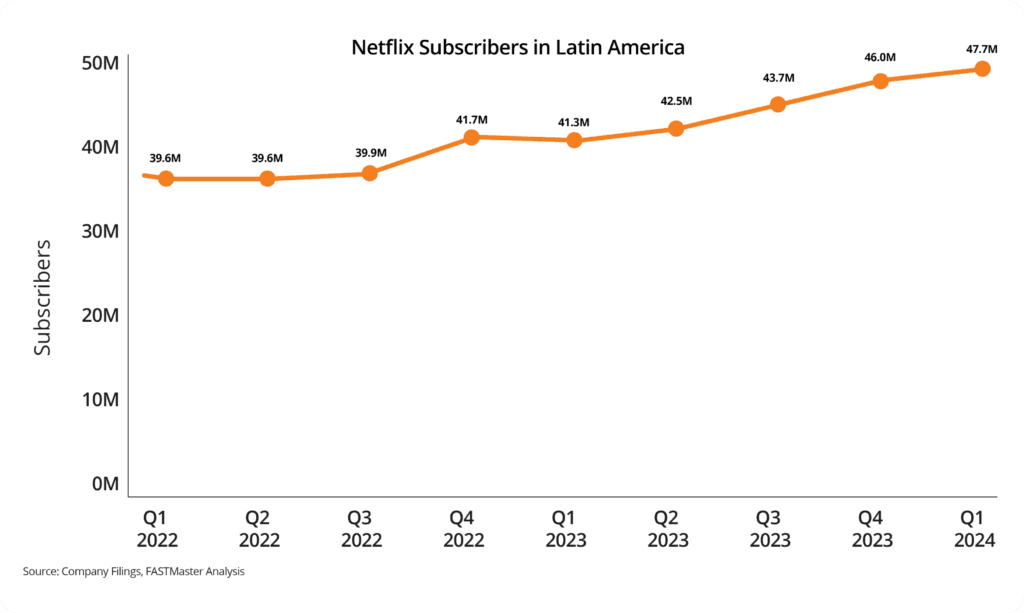

It is also a region that has historically opted for lower-priced TV and video products, and in the era of online video, streaming providers are leaning toward this. While Netflix subscriptions have grown in the region in the past few years and are predicted to continue on this trajectory, it’s likely that its ad-supported subscriptions will be what keeps them competitive.

As well as Latin America’s economic strength and viewers’ willingness to view content for free in exchange for sitting through ads, the region’s growing internet penetration (now at over 66%) presents a massive opportunity for content owners to reach audiences through online platforms.

Market dynamics and content Opportunities

The Spanish-speaking streaming audience in the US is substantial – 41.8 million people speak Spanish as their first language, and over 10 million people speak it as their secondary language – but the market is mature. This said, there is great potential to reach Spanish-speaking audiences in the US. But stronger marketing coupled with an understanding the cultural influences and languages spoken is essential if content owners are to reach these audiences with dubbed content.

Conversely, Latin American markets are experiencing a surge in demand for quality, localized content. For instance, FAST channels in Mexico and Brazil have shown significant growth, with genres like movies, TV series, and reality shows dominating the landscape. Despite the popularity of this genre, few channels come from major studios or entertainment companies, meaning now is prime time for smaller brands to establish themselves before the market becomes as saturated as in the US.

Content localization: The key to success

Localization is crucial for engaging Latin American audiences. Tailoring content to resonate with local cultures and languages—using regional slang, popular cultural references, and traditional customs—can significantly enhance viewer engagement. This is especially important in diverse markets like Brazil and Mexico, where unique cultural identities influence viewing preferences.

Strategic Insights and Takeaways

- Diverse content needs: The Spanish-language content in the US often comprises older programming, while fresh, localized content is in high demand in Latin America. Genres such as true crime and reality TV, underrepresented in Spanish-language FAST channels, present significant growth potential.

- Efficient use of resources: Platforms like Pluto TV leverage economies of scale by dubbing content for multi-country use, an approach that other content owners can emulate to maximize reach and minimize costs.

- Growth projections: SVOD subscriptions in Latin America are projected to grow from 110 million in 2023 to 165 million by 2029. This growth trajectory underscores the region’s increasing appetite for streaming content across various formats.

For content owners and distributors, now is the perfect time to tap into the burgeoning Latin American market. By focusing on localization and leveraging the region’s economic and technological growth, the potential for establishing a solid foothold in the free ad-supported streaming TV market there is substantial.

For more insights and strategic guidance on entering the Latin American streaming market, explore the Papercup and FASTMaster report.