MIP CANCUN 2024 edition will take on a special significance as LatAm and US Hispanic markets bounce back from the recent global economic downturn. Already in 2024 there is evidence that dealmaking is on an upward trajectory once more. Here are six compelling reasons why buyers, sellers and creators can’t afford to ignore this dynamic and innovative part of the world:

SVOD platforms are greenlighting LatAm shows

SVOD leaders like Netflix, Amazon Prime Video, Disney+ and TelevisaUnivision-owned streamer ViX are enjoying renewed growth across LatAm. Recent data from Digital TV Research predicts that SVODs subscriptions will rise from 110 million at the end of 2023 to 165 million by 2029. Market leader Netflix says DTVR will grow from its current base of 46 million subs to around 54 million in the region. One positive outcome of this growth is increased investment in local production. In the last six months of 2023, according to Ampere Analysis, Prime commissioned 23 originals, Netflix greenlit 21 and ViX contributed a further 16. One of the most exciting scripted projects set to launch is Netflix’s big budget adaptation of Gabriel Garcia Marquez’s beloved novel 100 Years Of Solitude.

Formats and factual are in demand

The year 2024 has seen leading LatAm players invest heavily in formats that can act as scheduling events. Mexico’s TV Azteca became the first broadcaster in LatAm to license BBC Studios’ The 1% Club, and also acquired Fremantle classic Family Feud. Elsewhere, Telefe Argentina has licensed Love Productions’ Bake Off while Break The Format Media (BTFM) optioned the rights to make a LatAm version of TBS format Ninja Warrior. There is also demand for completed versions of shows, with NBC Universal LatAm acquiring Peacock’s adaptation of The Traitors from All3Media International. In factual, regional players including DirecTV LatAm and AMC Networks International LatAM recently picked up a slew of natural history and factual entertainment programming from Blue Ant Studios.

BTFM optioned the rights to make a LatAm version of TBS format Ninja Warrior

Increased openness to co-production: In the post-Covid world, LatAm’s key players seem increasingly enthusiastic about international co-productions with trusted partners. Perhaps not surprisingly some of the best illustrations of this involve Turkish content companies – given the popularity of Turkish drama in the region. Inter Medya, for example, recently forged an alliance with Telemundo Global Studios, which has given birth to scripted series Hicran. This has now been sold to Caracol in Colombia. Inter Medya has a similar co-pro partnership with MGE of Chile. Evidence that the shift towards co-pro is a broad-based phenomenon is a partnership between Zee Content Sales of India and LatAm production company VIP 2000 TV to create Mexican telenovela Valentina, mi amor especial. Another positive is a new co-production agreement between Brazil and France, while generous film and TV tax rebates are making Uruguay an increasingly popular destination for international production.

LatAm content shines on global stage

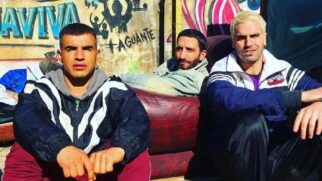

A 2023 report from BB Media underlined just how popular LatAM content has become on the global stage, with an estimated 7000 titles available outside the region. While Hispanic US and Spain are, self-evidently, key markets, the report found that English-speaking markets and Europe are increasingly turning to LatAM content for their streaming platforms. Mexico, Argentina, Brazil, Chile and Colombia rank as the top five countries of origin, with movies, drama and comedy the most in-demand genres. Series that have made their mark on Netflix in recent years include El Marginal (Argentina), The Queen of Flow (Colombia) and Ingoberable (Mexico). Meanwhile, Brazilian media giant Globo has just sold adaptation rights for Avenida Brasil to Ay Yapım in Turkey.

El Marginal has made its mark on Netflix in recent years.

The next FAST channel opportunity?

The US and Europe have led the FAST revolution, but there are strong indicators that LatAm is becoming increasingly significant. FAST pioneer Amagi, which keeps a regular track on the sector, recently reported that Connected TV and FAST are growing rapidly in markets including Brazil and Mexico. So it’s no surprise to see that leading players like Paramount-owned Pluto TV are prioritising the region. Content owners including ZDF Studios have also entered the market. Baskar Subramanian, CEO and co-founder of Amagi, says LatAm is experiencing “a remarkable transformation in its media landscape, with FAST leading the charge. As affordability and accessibility become key drivers, Brazil and Mexico are emerging as vibrant hubs for FAST adoption.” Other markets showing significant growth in FAST viewing include Peru, Chile, Colombia and Argentina.

Alternative access to the US

It’s no secret that English-language TV platforms in the US have cut back on content commissioning and acquisition over the 12-18 months. But it’s important to keep in mind that Hispanic Americans account for 20% of the total US population (circa 65 million). In other words, Spanish-language/Hispanic-centric platforms play a hugely significant cultural and commercial role in the world’s biggest economy. Hispanic US market leader TelevisaUnivision recently reported that its streaming service ViXnow has 50 million monthly active users, up 70% year-on-year – and it expects this segment of its business to become profitable later in 2024. MIPCANCUN provides a priceless opportunity to network with the US Hispanic market’s key players and learn about their current content requirements.

MIPCANCUN has established itself as the premier content and co-production event for companies embedded in, and engaged with, the Latin American and US Hispanic markets. It brings together leading decision-makers from distribution firms, content creation companies, channels and platforms.

Stay tuned for the registration opening, and join the 800 delegates making the annual trip to Yucatan !