2023 was a year to forget for many in the global TV business – with creative plans thrown in to disarray thanks to strikes, budget cuts, ballooning deficits and production inflation. Thankfully for some, 2024 looks a little brighter by comparison – but there is still plenty of upheaval to come. Here, the MIP Blog team highlights some of the creative, commercial and technological trends likely to emerge in the coming months.

Streamer consolidation on the horizon

The last 18 months have been brutal for subscription-based streaming services. Leading platforms including Disney+ have had to absorb big losses, while second tier players such as Viaplay, AMC and Lionsgate have been forced to make cutbacks. Early indications suggest there is more volatility to come in 2024 – with Warner Bros Discovery and Paramount Global considering a merger. If that crystallises, it’s highly likely there will be a new wave of consolidation.

This will reduce the number of potential customers for content creators, but it is unlikely to trigger a return to the deal rigidity of recent years. Streamers have learned to their cost that being too restrictive with content rights is both commercially and creatively detrimental. The fact that Disney has just licensed a raft of shows to Netflix – including Lost, How I Met Your Mother and This Is Us – suggests 2024 will see a lively content distribution market. Co-productions with global streamers are also likely to become the norm.

Unleashing The Power of AI

The year 2023 saw MIPCOM CANNES hold its first-ever Unlocking AI Summit. Presenting the Summit was Kati Bremme, head of innovation, France TV and advisor to HUB France IA. Her view is that: “AI is a game-changer – far more so than the hype surrounding the metaverse. The proof of this lies in the strike by Hollywood screenwriters and actors, who clearly grasp the potential of AI.”

Bremme says there are several questions to address. For example: “How can AI, instead of supplanting creative professionals, act as an accelerator for creativity? What legal framework should be established for new challenges surrounding IP, particularly now AI is capable of imitating image, voice, and style? What will be our relationship to truth and reality in a world where falsehoods can now be mass-produced?” The New York Times’ decision to sue ChatGPT owner OpenAI is an intriguing development.

So what might we expect from AI in 2024? Possibilities include: easy visualisation of settings and backdrops; brainstorming of plot ideas; closer collaboration across language barriers; the facilitation of networking; faster and better editing; the rapid creation of shoulder content; visual and vocal cloning; personalised user experience; and interactive narratives with multiple outcomes. For the distribution business, AI will enable easier content localisation and support the creation of marketing materials.

Unscripted Format Business Will Thrive

The format business is too diverse and dynamic to sum up succinctly – but with content budgets under pressure there’s no question the sector will do well in 2024. There is undoubtedly an appetite for reboots, with shows like Who Wants To Be A Millionaire?, Dancing With The Stars, Real Housewives, Wheel Of Fortune and Supernanny all enjoying comebacks.

Away from reboots, the big story is the pursuit of formats with scale, ambition and psychological depth. The recent launches of 007: Road To A Million and Squid Game: The Challenge mark an exciting development for the business, which is likely to lead to more formats built on the back of iconic IP. It’s already happened in stage shows and computer games so why not in the field of TV entertainment formats? The year 2024 will also see a new lease of life for physical gameshows like Gladiator, and the continued search for ‘the next Traitors’. An early contender in this respect is Netflix’s show The Trust: A Game Of Greed, which dropped in the UK at the start of 2024.

Sports-Themed Programming Expands Its Influence xxx

The BBC panel show A Question Of Sport has just been axed by the BBC after 50 years – but this is a rare setback for a genre in the ascendancy. Driven by demand from the streamers, sport is seeing a surge of activity in the unscripted arena. After well-received productions like Welcome To Wrexham, Haaland Conquers England, At Home With The Furys and Beckham in 2023, 2024 will see an expanded range of output from Netflix, Amazon and other big streamers.

If there’s an explanation for this rise in non-live sports content, it is the fact that it delivers an emphatic win-win for those involved. For platforms, high-quality access-driven sports documentaries cut through the clutter of competition and provide support for their increased investment in live sports rights. For the sporting subjects, such programmes fuel their own commercial and brand-building agendas.

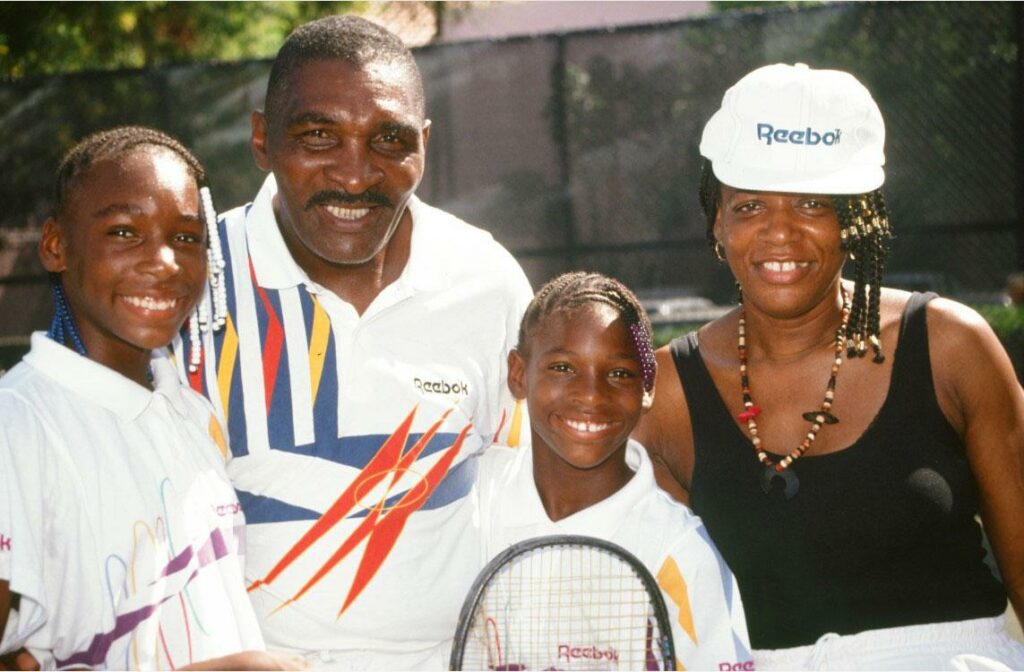

Sport has caught the attention of Europe’s major production/distribution groups. Fremantle, for example, recently acquired the global distribution rights to feature documentary On The Line: The Richard Williams Story. Elsewhere, Banijay CEO Marco Bassetti has announced that his company is planning to grow its ‘sportainment’ output in response to demand from the global streaming platforms.

FAST-forward towards integration

Enthusiasm for FAST channels will continue in 2024, with industry leaders including BBC Studios, Banijay, Warner Bros Discovery and Blue Ant Media all keen to expand their global portfolios. Possible developments in 2024 include more original content, increased exclusivity, aggressive culling of weak channels and greater emphasis on personalisation. Also keep an eye out for how single-IP FAST channels – for example Top Gear, Deal Or No Deal, Hell’s Kitchen, Drag Race – continue to build momentum and stay relevant for fans.

More important than all of this, perhaps, is increased integration between FAST and the existing media ecosystem. FAST may be the media industry’s favourite buzzword right now but it means nothing to consumers – who simply perceive FAST as more free channels. Increasingly, FAST channels are appearing in more broadly-configured destinations, such as pay-TV platforms (for example Virgin O2) and broadcaster VOD platforms (ITVX). And they are being positioned as potential gateways to paid-for services – Freevee to Amazon, Pluto TV to Paramount+, BBC Studios channels to BritBox. With SVOD streamers launching advertising-supported tiers, the strategy of placing of SVOD, AVOD and FAST into silos will soon prove ineffective. And that might trigger fallout in the huge number of platforms currently servicing FAST.

And this year YouTube is likely to become a more influential player in the TV landscape. Already, almost half of YouTube viewing takes place on TV screens, a growing trend on which the platform is keen to build. YouTube as content commissioner/channel aggregator/AVOD platform are all possibilities that could have a big impact on the existing landscape.

Cutting Through In A Budget Crisis: Three Pathways

No-one is under any illusions that budgets will be tight in 2024, meaning that content commissioners will be looking for ways to make their programming investment stretch as far as possible. This suggests that the current shift in the direction of cross-border co-productions will continue. As 2023 ended, broadcasters, producers, distributors and streamers all made it clear that pooling budgets to elevate shows is a high priority. An example is Mediapro Studios’ agreement to partner with BBC Studios on The Famous Five.

Long-term Distribution Partnerships

Alongside co-productions there will be a renewed urgency to establish long-term distribution partnerships – to ensure a cost-effective content pipeline. At MIPCOM, for example, A+E Networks announced a substantially expanded partnership with German media giant Seven.One Entertainment Group, giving the latter access to proven franchises including Pawn Stars, Storage Wars, Forged in Fire, and Curse of Oak Island.

Locally-themed Factual Programming

If there’s a downside to co-production and distribution deals, it’s that they don’t necessarily enable regional channels and platforms to create editorial differentiation from global streaming platforms. For this reason, 2024 is also likely to see robust investment in locally-themed factual programming. ProSiebenSat., for example, recently announced plans to increase its investment in local content, with its streaming platform Joyn to be a key beneficiary. Bert Habets, group CEO of ProSiebenSat.1, said: “We will invest significantly more in local content from 2024, offering our viewers a unique programming experience to differentiate ourselves from the competitors of Joyn.”

At first sight, local content doesn’t lend itself to global tape sale distribution – but it can play into the growing market for scripted and unscripted formats.

To discover more trends and insights, join us at MIPTV 8 – 10 April 2024 !