The “Golden Age of the Documentary” is over.

It’s passing clouds what remains: a multi-billion-dollar, international market for unscripted content.

And that means opportunities for factual producers.

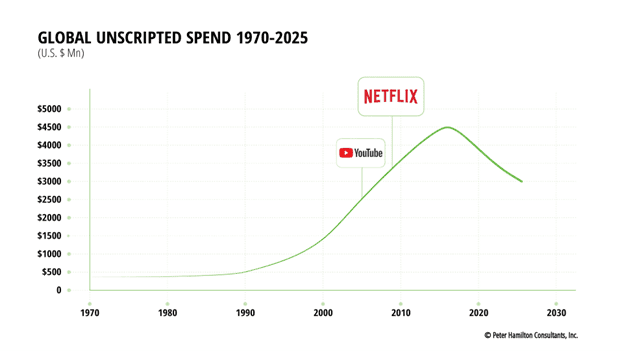

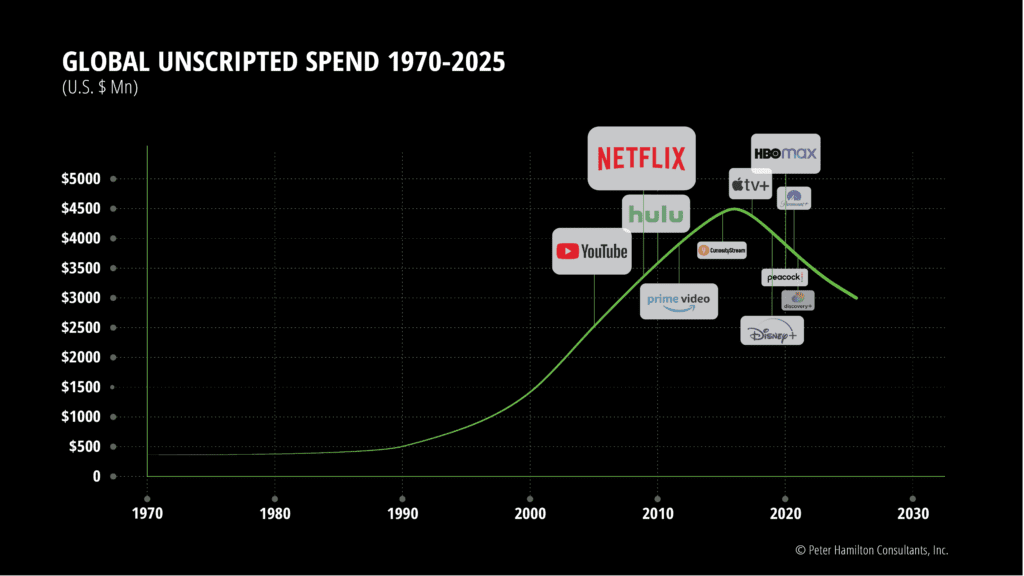

Growth in spending on originals and acquisitions seemed unstoppable for decade after decade.

From its modest scale in the Broadcast era, the successful PayTV model drove the annual production spend across the global unscripted sector to nearly $5 billion, according to my estimate.

The wave peaked midway through the last decade when the new streaming model set the unscripted market into a challenging decline.

- Here’s what happened.

- Why

- And how producers can look beyond today’s pain and deliver tomorrow’s winners.

Sundance goes cold

The feature documentary is the most prestigious unscripted format, and Sundance 2023 is a useful starting point to consider the unforgiving economics of its “Golden Age.”

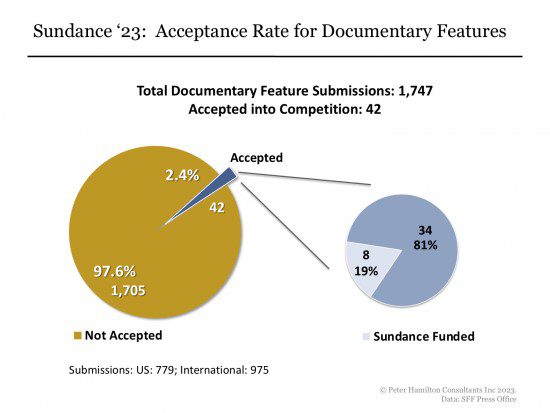

I reported in Documentary Business that 1,747 feature documentaries were submitted this year, and 24 were selected for the main festival competition.

- Only one 2023 finalist left Sundance with a distribution deal!

- The rumored sales price was $3 million for THE ETERNAL MEMORY.

- The buyer: MTV Documentary Films.

According to veteran distribution strategist Peter Broderick, ”Netflix, Amazon Prime, Apple TV+, and Hulu didn’t buy a single doc in Park City or in the following months.”

Sundance 2019 told a different story.

That’s when Netflix fought off streamers and distributors to pay $10 million for the rights to the crowd pleaser KNOCK DOWN THE HOUSE.

Peter Broderick reported that another $10 million was committed to several other films, including $3 million by Netflix for AMERICAN FACTORY.

Boom to Gloom

What’s driving this boom to bust cycle?

For several decades, the documentary feature commanded the zeitgeist, drawing cultural trend-setters, billionaire funders, ex-presidents and princes, legendary movie directors, and more.

Despite all the buzz generated by Sundance and the Oscars, the feature-length format has always faced a powerful economic headwind: negligible box office sales.

A more powerful negative factor is that the networks’ slots and programming budgets for features have been in steady decline, for both public broadcasters and PayTV channels

Most network schedulers work in hour-long blocks. They also prefer series because they offer efficiencies in production and promotion. One-off stories that are delivered in the non-standard, 90-minute format are an increasingly difficult fit.

Add declining licensing revenues to meagre box office returns and you have a formula in which very few feature documentaries enjoy a profitable outlook.

The PayTV Boom

The PayTV model was the driver of that remarkable, decades-long boom in spending on unscripted programs. Funded by advertising and a subscriber base that peaked in the US at over 100 million homes, dozens of factual channels ordered 100, 200, 500, and sometimes more new hours each year.

Creative producers and programmers blended genres and formats to create fresh popular shows.

Network operators launched their branded spinoffs in ever narrower genres, and often across multiple territories. The international marketplace took off in the pursuit of sharing rights and costs.

Then came Netflix

The feature documentary and big-budget, prestigious special initially enjoyed a highly publicized bounce when Netflix began to transform the market.

Taking a page out of HBO’s PayTV playbook, Netflix set about building a pipeline that delivered a selection of feature documentary acquisitions and commissions that messaged “premium” and “quality.”

Productions like KNOCK DOWN THE HOUSE were pre-sold with Sundance or Oscar buzz. Or they were press-friendly because they were made by super A-listers, for example, Spielberg and DiCaprio, or were about celebrities.

Netflix also struck gold with multi-season unscripted series when MAKING A MURDERER and TIGER KING ranked among its most viewed hit programs. True Crime joined bios with insider access to popular Music greats as the most watched documentary genres.

Flawed model

The success of Netflix exposed the flaw in the PayTV model. That is that viewers were paying for “400 channels” but mostly watched only a half-dozen of them.

When offered the streaming option, consumers cut the cord in increasing numbers. Fewer viewers for the channels meant lost advertising revenues, triggering rolling cuts in programming budgets.

A vicious cycle set in, one that a leading analyst has described as the “doom loop” for legacy PayTV channels and broadcasters.

Netflix’s runaway success ignited a rush to launch streaming platforms by established content players, notably Disney, Paramount, and Discovery. They were joined by tech giants like Apple and Amazon who are attracted to the prestige that video adds to their brands and operations.

All of them targeted unscripted series, specials and formats, though none of them matched Netflix’s reported $18 billion 2023 budget for programming across all genres.

Breaking UP?

The romance between streamers and unscripted programs came to a “pause” last year.

Rising interest rates hit the entire tech entertainment sector, increasing the cost of their investment in the new platforms. Meanwhile, consumers had become more selective, canceling their subscriptions to second choice services more frequently than expected.

Disney CEO Bob Iger spoke for the new streamers when he advised that the investment required to reach profitability was billions more than forecast.

Disney, Warner Bros Discovery, Paramount and others cut their streaming platform’s content budgets and shed staff dedicated to acquisitions.

Unlike Netflix, an operator of legacy networks like Disney also had to walk the tightrope between providing its streamer Disney+ pumped with fresh Nat Geo programs, while keeping cable viewers excited about the legacy Nat Geo Channel.

Summing up the situation, veteran factual network executive Dan Salerno says, “Commissioning volume is down, and full commissions are decreasing in favor of co-productions and alternative financing. The good news is that European and other global partners continue to have a healthy co-production appetite for factual. Along with the rise of AVOD and FAST services, there are more outlets than ever to call on, provided one has the time and patience to navigate this new old world.

Paths to success

There are proven strategies for creating the best chance for success amidst this unsettled programming landscape.

Here are my Top 10 recommendations – ones that I share with producers seeking a home for their documentary projects.

- Remember that networks and platforms are mainly in the entertainment business, and not the change-the-world business.

- Validate that your film will deliver in spades the trifecta for successful storytelling: Big Characters; High Stakes; and proof that you enjoy Unique Access to the story.

- Hire a lawyer or business affairs expert who will help you navigate the thicket of online rights.

- Start early with an outreach plan that shows your backers how your film will efficiently reach your target audience.

- You need video to establish your concept and characters. But minimize spending on your production until it is close to being fully funded by donors or private investors.

- Seek out foundations, corporate sponsors and government agencies as your marketing partners so that your film is integral to their message and campaign.

- Share the broad concept with potential buyers, distributors, and agents. Update them regularly.

- That means attending global markets like MIPDOC and MIPCOM where you will discover if potential buyers have an interest in your project. You’ll also experience the serendipity of a chance meeting that leads to a successful partnership.

- Be flexible about your format. Commit to creating a television special version of your feature.

- Plan to submit your completed film to festivals that specialize in your genre, like Jackson Hole for Wildlife. You will get feedback from the buyers who are most committed to your topic.