The current landscape for the industry brings to the fore the fundamental change in the internal architecture and structure of the industry and how it does business. The rise of the streaming platforms, who are using the internet to give them global reach and valuable insight into audience behaviour, has overturned the traditional power structures in the industry.

The likes of Netflix and Amazon, and numerous niche by category but global by reach streamers heralded the rise of content businesses that understand that entertainment is now an internet delivered product. Digital by DNA, the streamers, increasingly dominate the acquisition of content. Hungry to feed a “glocal audience” (global but with localised catalogues for each region), these companies recognise that great stories can come from anywhere and can travel everywhere.

The explosion of entertainment options brought on by the reduction in cost to launch has inevitably resulted in audience fragmentation and lower viewership numbers on a per channel per country basis for many traditional broadcasters, and this inevitably translates to diminishing acquisition budgets and a decrease in the value of each individual deal.

But what does all this mean for those in the business of film and TV content acquisition and distribution?

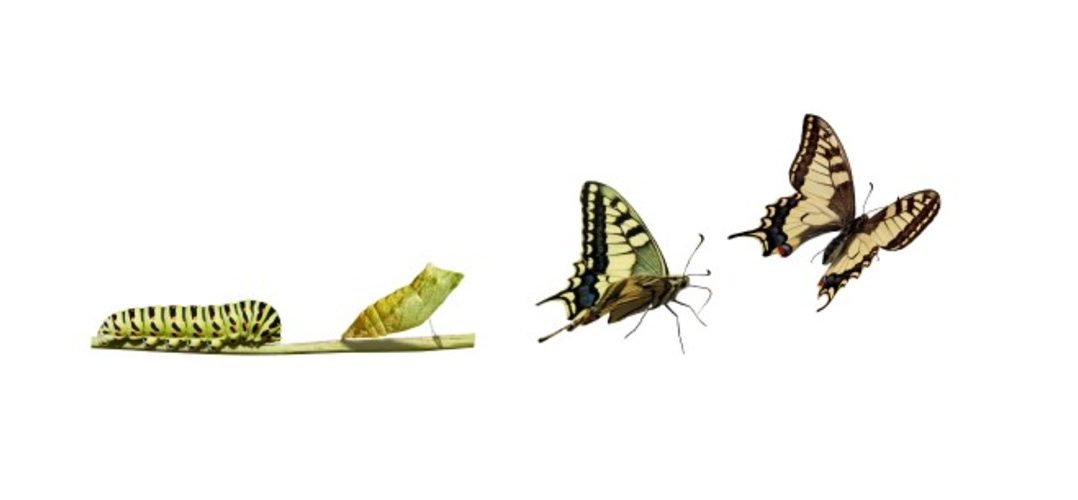

Welcome to the new digital content economy and the evolution from ‘few first-window, high-value exclusive’ deals to ‘many non-exclusive & multi-territory.’

With the explosion in the number of platforms, the number of deal opportunities has increased many-fold for sellers that can achieve global reach for their distribution. Opportunities not just for front catalogue, but also mid and back catalogue content.

As such, not only has managing rights and availability across multiple territories has become that much more complex; the way value is negotiated between buyer and seller has also changed. Streamers know – at an atomic level of granularity – who has watched what, for how long and when. This data is used to inform far more data-driven content choices and buying strategies, leading to a preference for performance-based pricing.

Today, speed and access turn out to be critical, especially for buyers.

In order to keep pace with internet-savvy consumers, buyers have to source, negotiate and acquire content faster and more widely than they ever have before. Content deals need to be done in days and weeks, not 3-6 months.

Buyers need to look out-of-the-box for fresh content from new sources, rather than limit themselves to the same portfolio of distributors they have traditionally dealt with. Backed by data-driven consumer insights, today’s buyers can cherry-pick the best content for their audiences from anywhere in the world.

To run at internet speed and play by internet rules, businesses must digitally transform their traditional, manual tool set. That means moving away from one-to-one pitching for each deal, whether it’s face-to-face or via a zoom video call, to a savvier way that provides better return on investment for your content.

The new toolkit to release this value is about digital marketing and sophisticated digital platforms, such as content marketplaces, which give sellers global reach and the ability to monetise their entire catalogue. And provide buyers the opportunity to search a global catalogue and acquire titles, with deals on platforms like Vuulr typically closing in 10 days.

That’s not to say the old ways are over. While much of content discovery, negotiation and transaction will go digital, there is still a vital place for face to face meetings at physical events worldwide, when they become possible again. Such events will become more focused on networking, knowledge sharing and developing complex deals such as co-production deals.