The world of television has dramatically changed over the past few years. Traditional linear and digital non-linear television now co-exist equally while new content and platforms constantly disrupt the landscape. These intersections define MIPCOM’s 2016 theme of “The New Television:” a whole new world where television has never been so in demand.

However, with this rapid evolution, content providers struggle to keep up with the growing demands of consumers who can watch what they want, where they want, and how they want.

To illuminate the current and future state of the industry, the latest whitepaper from Parrot Analytics unveils who is winning in today’s global television landscape – across broadcast, cable, premium cable, SVOD, and AVOD platforms – and dives deeply into the trends of content expansion and globalisation and their implications for the future.

Some of the key insights in the whitepaper include:

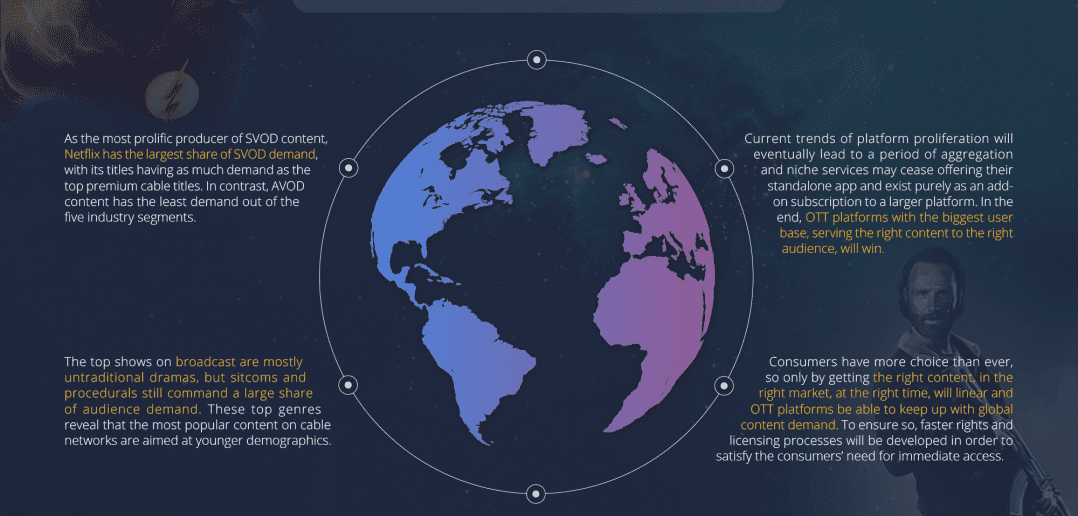

- Current trends of platform proliferation will eventually lead to a period of aggregation and niche services may cease offering their standalone app and exist purely as an add-on subscription to a larger platform. In the end, OTT platforms with the biggest user base, serving the right content to the right audience, will win.

- Consumers have more choice than ever, so only by getting the right content, in the right market, at the right time, will linear and OTT platforms be able to keep up with global content demand. To ensure so, faster rights and licensing processes will be developed in order to satisfy the consumers’ need for immediate access.

- The top shows on broadcast are mostly untraditional dramas, but sitcoms and procedurals still command a large share of audience demand. These top genres reveal that the most popular content on cable networks are aimed at younger demographics.

- Cable channels have the most diversity of genres and audiences, while premium cable is dominated by graphic dramas.

- As the most prolific producer of SVOD content, Netflix has the largest share of SVOD demand, with its titles having as much demand as the top premium cable titles. In contrast, AVOD content has the least demand out of the five industry segments.

For more insights, download the white paper here