Fifty years ago, watching TV on public transport felt like a sci-fi dream. Now, catching up on sci-fi series Sense8 – a Netflix Original – on the way to work seems like the most normal thing. The current media environment is moving extremely fast. YouTube just celebrated its 10th anniversary. Netflix launched in Europe only three years ago. From new devices on which we view content, to a whole range of new online services, a wave of innovation has swept across television in the past decade.

So, what will TV look like in five years?

The TV industry was shaken a few weeks ago when TV-related stocks fell on fears of pay TV cord-cutting. A substantial loss of subscribers at ESPN (which is owned by Disney) triggered fears about cord-cutting and the rise of streaming services. This led to another massive selloff of TV-related assets across giant media companies such as Disney, Comcast, 21st Century Fox and Time Warner. A prominent industry analyst even said that the entire industry is “structurally impaired.”

Therefore, it did not come as a surprise when NBC Universal (owned by Comcast and GE) announced that it was heavily investing ($200 million for each) in popular digital media companies Buzzfeed and Vox Media. These deals are surely a play in attracting younger consumers to NBCU’s TV and digital assets, as TV networks are having trouble marketing shows to younger audiences who aren’t watching appointment TV, and therefore, aren’t seeing any promos. BuzzFeed and Vox can potentially serve as promotional vehicles where NBCU can create tie-ins or sponsored content. They also present an opportunity to expand the company’s data-driven ad products.

NBCU’s announcement comes not long after A&E Networks (owned by Disney and Hearst) invested $250 million in Vice Media last summer. Vice Media, the web-video upstart whose edgy content has drawn both investors (News Corp also invested $70 million) and millennial viewers, took a major step toward its goal of becoming a mainstream television outlet when it announced a multiyear programming agreement with HBO. The deal increases Vice’s footprint on the premium channel. Vice has now a daily newscast and a branded channel on HBO’s streaming service HBO Now.

HBO, however, isn’t the only network offering Vice a TV channel. Vice will also take over A&E Networks’ H2 cable-TV channel next year and debut a channel on Verizon’s upcoming internet-delivered TV service.

There are also persistent rumours that Viacom will buy Thrillist. Thrillist Media Group is a digital media company consisting of three brands: food, drink and travel property Thrillist; technology and lifestyle site Supercompressor; and fashion site JackThreads. CEO Ben Lerer denies these rumours. But fact is the media company isn’t profitable, and Viacom may be interested.

It’s not only online publishers such as Thrillist, Vice, and Buzzfeed, though, that attract TV networks. In May 2014, Disney surprised the digital video world by spending $500 million on Maker Studios, a video network that generated billions of views a month on YouTube.

What’s currently happening is that investment flows from old television networks to new internet properties – and revenues achieved by these Internet companies will flow right back to traditional television companies. However, these flows will affect the actual content.

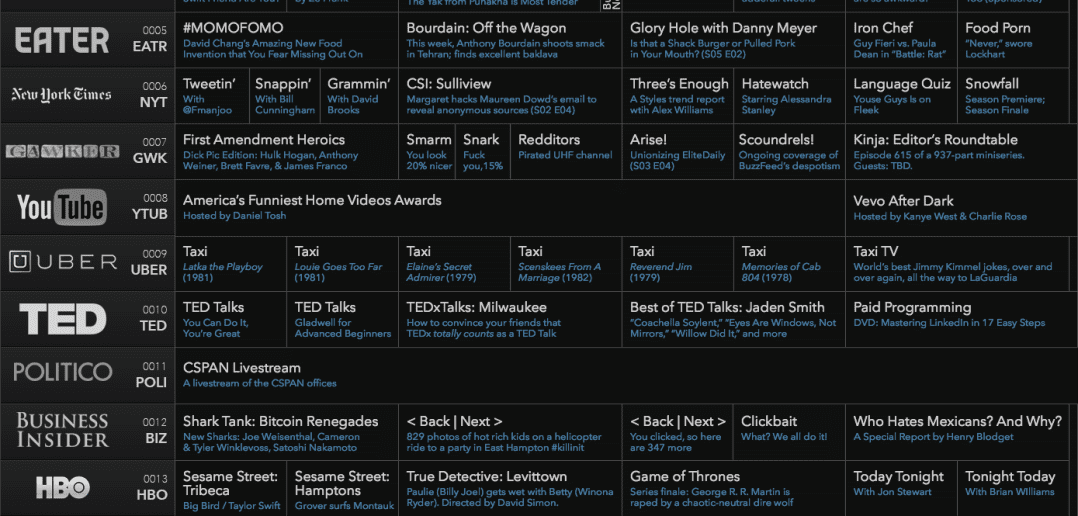

So when we look at a TV channel guide in 2020 it might look a bit or even a lot like the image at the top of this post (click here for full-size version. Source: Rex Sorgatz, on Medium).

What do you think?

Sandra Lehner is senior social TV manager at joiz, and a frequent contributor to MIPBlog. Check out all of her posts here.

Un commentaire

Good article Sandra……but there probably won’t be a schedule any more…..