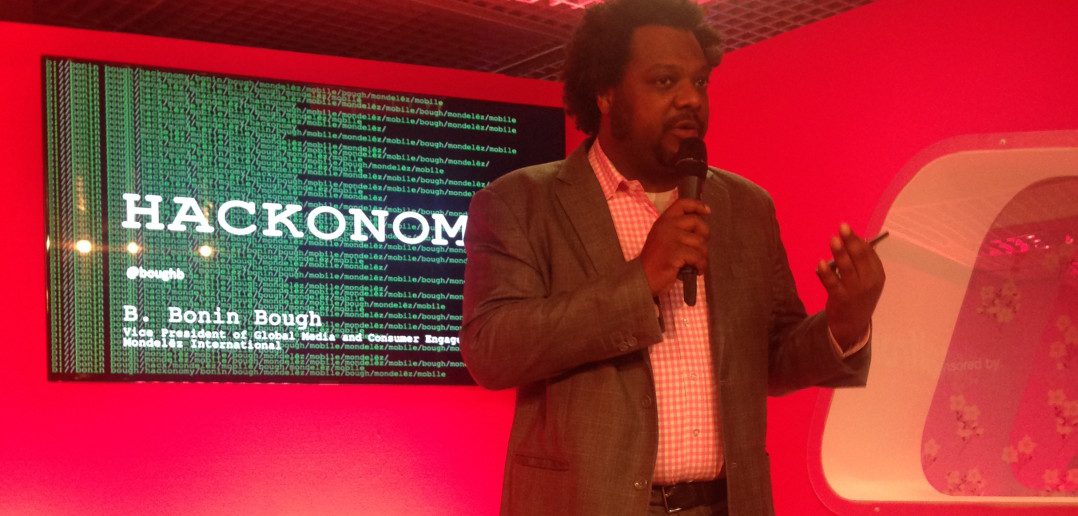

Bonin Bough, chief media & ecommerce officer of Mondelēz International,home to some of the world’s most beloved candy brands, came by this morning to talk about how the company’s responded to changes in the TV industry, using brand storytelling across multiple platforms.

Bough kicked off by saying three big changes have utterly disrupted television:

– Cost for TV reach has gone up dramatically because of customer fragmentation

– The amount of content necessary to satisfy consumption is greater than ever, so the old way of content creation no longer makes sense in terms of volume and cost

– The advent of the mobile device, which doesn’t just let you consume content constantly; it lets you create and share it instantly.

« We have become the most distracted society in human history, » said Bough. « But we’ll never admit we’re distracted! We say ‘keep talking to me while I’m texting, because I’m multi-tasking’. But we’re lying to you. » A psychiatric study discovered people multi-tasking suffer a lower IQ and attention span than people doing equivalent tasks while smoking marijuana.

Still, he says, mobile is huge: There are seven billion people on earth, and 5,1 billion own a cellphone … while only 4,2 billion own a toothbrush.

« Using your mobile phone is as addictive as cocaine. Twitter, Facebook, Snapchat might all be gateway drugs! » Bough explained.

A study finds that by 2020, every CPG sold in-store will be connected to the internet somehow, said Bough. « We sell 8bn products a month; in some respect, we might become one of the world’s largest tech companies. That scares me; we don’t look like a tech company. How can we identify the opportunities to unlock the future ahead of us, and how will we lay out the roadmap and partner with people like you? »

Here’s his gameplan:

Rethink mobility. « People think of mobile as another channel to advertise against, but it’s the one device the consumer has with them through the entire consumer journey, » said Bough. « How can we use content to drive that experience? »

Real-time experience. « The consumer expects a real-time reaction to what’s happening in culture or what’s happening on the screen or in their hand, » Bough explained. « People think about real-time as FB posts. But how will video become a real-time content weapon for us? »

Media monetisation. « We’ve launched a venture fund to bring us back into entertainment content ownership. »

Aspiration & allocation. « It’s one thing to say you’re a content creaetor; it’s another thing to invest behind it, » Bough said.

TV/video. « We believe there’s no difference between TV and video, » said Bough. « We don’t care, we think it’s all single platform, whenever you want. »

Culture vs. Cluster. « You used to have to create content for clusters of people; now you can create culturally-relevant content that resonates more deeply and has a greater cultural meaning. » This is something you can take advantage of.

Bough chased these insights with a number of case studies that show how Mondelēz is trying to bring them to life. You’ll probably recognise a few.

First up was, of course, was Oreo’s Daily Twist, which breathed relevant new life into a 100-year-old cookie.

Then there was the satirical Colbert Report’s Wheat Thins product integration. For it to work on the show and with fans, Colbert showedMondelēz the script and insisted it was this way or no way. According to Bough, they said yes, and he never regrets it.

« At this time, Viacom launched a platform called Clip n’ Share, which lets you share short 15-second clips and share them on your social channels, » Bough added. Mondelēz signed up to participate and were surprised by the findings.

« When we looked at the report, we saw that what we were getting was unduplicated reach across Twitter and on mobile. » He started thinking of how that could be used to their advantage.

One fruit of those thoughts was Trident’s Fuse TV, which featured a show called the Trending 10, the first-ever show built from Twitter.

Basically, Fuse TV is « a heat tracker of trends happening on Twitter. » It’s a 30-minute show that airs morning and night, but is cut into 22 pieces of video content that is then pushed out across Twitter throughout the day, when you’re most likely to impulse-buy gum.

To get such a high amount of content out there efficiently, they also started working on Vine, and eventually decided to just drop the brand into the hands of Vine creators.

Per Bough, these examples highlight Mondelēz’s progression in using multiple content creators, multiple distribution platforms, and real-time, and bringing it to life. Eventually, you end up making content like this:

After providing all these examples, Bough was asked if he truly believes the 30-second ad is dead. His response also provided insight on what’s happened to this television standby, and how these experiments are actually faring for Mondelēz.

« It’s not dead at all, » he said. « It’s still a huge piece of communication. The problem is, we did a bunch of research, and we saw we were hitting a point of diminishing return, earlier and earlier on our TV investments. »

He went on to explain, « When we looked beneath that, two things were happening: Audiences are fragmenting exponentially. But our money is growing incrementally. And then there are those devices you have in your pocket. »

As a result, they’ve spent the past three years conducting worldwide tests like the ones that appear above this post. « We used to buy 80% reach on TV. We can’t do that anymore. Once we hit 50%, the cost for getting unduplicated reach gets so expensive, » he explained. « So we’ve been experimenting, but we’re still not able to get to the scale we used to. »

But the biggest challenge is the cost of a 30-second spot on its own. « It’s huge! » Bough exclaimed. « When you apply that to the throwaway content we have with a Vine celebrity, the economics don’t make sense yet. »

To get a sense of what he’s talking about, he told us about Tongle, a global network of content creators. « You provide a brief and go through iteration steps to create a piece, » he explained. « We created six pieces with them for $30.000. »

One of them appears below, basically cost $5.000, and is TV-quality in Bough’s opinion. « The content economics have to change, » he emphasised again.

The trick, in essence, is to lower production costs while increasing upside by hacking the platform opportunities around you, said Bough. Candy Crush, for example, drove him nuts because Mondelez should be kicking its butt, candy and gaming-wise. « You’ll see us do more open platform, open IP up to game developers, » he said.

In the meantime, two good examples of opportunity and platform-hacking are CheeseRank and Oreo’s Trending Vending Machine.

Bough dubs CheeseRank « the Buzzfeed of cheese ». The model is simple and wildly efficient: « What we do on that platform is buy targeted traffic for $2 on Facebook and bring them to the site. All the cheese articles are transparently ranked by Ritz, then we sell the ads in a programmatic exchange for $5. So it’s basically arbitrage and it’s cash-positive. How do we build more models like that? »

Oreo’s Trending Vending Machine, on the other hand, was a huge hardware-heavy production for SXSW, and it let people « print » their own customised Oreo cookies.

https://www.youtube.com/watch?v=gbKZBQHNhhc

Everything, though, always comes back to mobile.

« We commited to spend 10% of media dollars on mobile globally, » Bough said. « We’re at 6-8% now, and it varies in different markets. So we’re pretty aggressive, but when we look at our ROI we’ve increased dramatically over the last 3 years, to the tune of multiple billions of dollars incrementally as a result of the digital changes we’ve made. »

No more excuses.