Is online video the new Eldorado for Hollywood? As far as cinema is concerned, 2015 started with at least two major announcements: Amazon’s move into the movie business – and its choice, unlike Netflix, to give films a 4- to 8-week exclusive theatrical window, StreamDaily reports – and, as Business Insider points out… legendary filmmaker Woody Allen’s decision to create his first-ever TV series for the same platform! From the director who once stated that « in Beverly Hills, they don’t throw their garbage away, they make it into television shows », this is a surprise… But also a sign that times have changed.

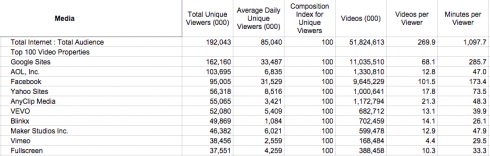

The very fact that online video services are trying — and paying — to get top talent on board all but shows the sector’s increased competitivity, which will undoubtedly keep growing in 2015. That is, at least, what the figures analysed by VideoInk seem to suggest (see chart below, click to enlarge):

« According to the latest comScore data, Google/YouTube is still the top player in the online video market with 162.1 million unique viewers in the US in November. But the distance between Google/YouTube and those sitting below it on the monthly comScore charts is not as great as it used to be. »

Facebook in particular is gaining ground as it will soon allow all businesses to « choose a featured video to be displayed extra-large with a live comment feed atop their Page », TechCrunch notes. But auto-play videos have already transformed the social network, getting more views than YouTube’s in many cases. To quote but one result of this successful strategy, Facebook scored a big partner in December when it signed with the National Football League, posting short video clips of the NFL on newsfeeds, automatically followed by ads from Verizon Wireless, The Wall Street Journal reports.

Can broadcasters survive in this more-aggressive-than-ever sector, where more and more investments move to online video? The Wrap‘s point is clear: ad revenues remain key for networks, which will focus more on « top-tier live TV experiences » in years to come in order not to become obsolete, MediaPost writes. Indeed, as viewers turn to new screens and progressively embrace delayed viewing, those channels « are scrambling to find alternative ways to truly account for viewership. » This shift in the way TV ratings are made is even quoted by Adweek as one of last year’s « 5 ways television changed dramatically »: facing a lack of visibility when it comes to tablets and mobiles, ratings measurement leader Nielsen is striving to « make its gross ratings point tool, the one advertisers pay for in non-theoretical money, the standard across not just linear cable and broadcast, but new media, as well. »

The world of online video isn’t spared by controversies either, actually. The first issue raised in the past few weeks has to do with offline viewing. Consumers may want it, but Netflix itself admitted that it’s « never going to happen » on its service, TechRadar reports. Amazon stepped into the breach and declared it would make offline viewing available beyond Fire tablets in the future.

The second problem these online video platforms currently face is the true size of their subscriber bases: are the figures as accurate as we thought? Quoting a GlobalWebIndex survey, Variety points out that, thanks to virtual private networks, there could be no less than « 30 million users accessing Netflix in countries where the service is not available, approximately 20 million of them through China alone. »

When it comes to YouTube, one thing is certain: the online video platform’s stars do have subscribers, and not just a few! Interestingly enough, DC Toys Collector (watch her most viewed video to date above), the highest YouTube earner of 2014, made $5 million… just by opening Disney toy packages, Fusion reports! As The Guardian points out, the trends observed in the past years were confirmed in 2014: « games, music and children’s channels ruled the roost on YouTube, » with its biggest star PewDiePie totalising 4.1 billion views and over 3.8 subscribers. However, The New York Times underlines a « long-simmering revolt among YouTube creators, » now more popular among teens than most Hollywood stars, but who don’t get the same economics when it comes to revenues. That is the reason why the platform is investing more and more in its native stars, « spending an undisclosed amount to help cover the production and marketing costs for a number of new shows. » Its head of originals Alex Carloss just declared at NATPE that a new wave of content funding will launch by the end of 2015, VideoInk writes.

After some impressive power plays and acquisitions in the online video world in 2014 – read VideoInk’s list here – what will this year be made of? More competition between platforms, as Maker Studios’ deal with Vimeo suggests, according to TechCrunch? A raging battle for top talent like filmmakers? There will definitely casualties in this upcoming war, but as Woody Allen himself said: « If you’re not failing every now and again, it’s a sign you aren’t doing anything very innovative »?

Discover more TV industry knowledge on our TV Biz News page, where the hottest business developments are curated by the MIP Markets team, via scoop.it… And see you at the MIP Digital Fronts in April to witness the latest innovations in the digital content marketplace!

Top picture via Shutterstock – Lucky Team Studio

Un commentaire

If you combine Maker/ Fullscreen/ Vevo figures to the Google Sites figure (since they are all YouTube platforms predominantly), YouTube is still the leader by a wide margin but it is true that competition is intensifying. It will be interesting to see how YouTube reacts to competitive moves like Vimeo’s example above and Jason Kilar’s Vessel which is creating a « first window » for some of YouTube’s biggest content creators by offering them higher CPMs and more revenues.

YouTube seems to be going back to its roots as it announced that the next phase of its Originals program will focus on its own home-grown talent rather than professional brands or producers from the TV world.

Broadcasters remain focused on « following the money » and their strategy has been somewhat validated (to paraphrase Mark Twain, « reports of the death of television have been greatly exaggerated. ») The forward-looking broadcasters however are making sure their content is available (even if in limited form) on multiple platforms and experimenting to find the right mix of protecting existing revenue streams while starting to build new revenue paths and offering added convenience to their audience. Those, specially outside the US, who think that they can just sit and rely on fixed business models and unchanging viewer consumption habits (the « it won’t happen here syndrome ») will be the ones who risk losing out in the medium term.